-

- Find Care

-

- Visitor Information

- Find a Location

- Shuttles

- Visitor Policies

-

-

-

- Our Virtual Care Options

- Virtual Urgent Care

- Virtual Visits for Primary & Specialty Care

- Online Second Opinions

- Participate in Research

-

- Contact us

-

- For Innovators

- Commercialization Guide for Innovators

-

-

- Research News

- Alzheimer's Disease

- Artificial Intelligence

-

- Overview

-

- Overview

- Getting Started

- New to Mass General Brigham

- International Patient Services

- What Is Patient Gateway?

- Planning Your Visit

- Find a Doctor (opens link in new tab)

- Appointments

- Patient Resources

- Health & Wellness

- Flu, COVID-19, & RSV

- Billing & Insurance

- Financial Assistance

- Medicare and MassHealth ACOs

- Participate in Research

- Educational Resources

- Visitor Information

- Find a Location

- Shuttles

- Visitor Policies

- Find Care

-

- Overview

- Our Virtual Care Options

- Virtual Urgent Care

- Virtual Visits for Primary & Specialty Care

- Online Second Opinions

-

- Overview

- Participate in Research

-

- Overview

- About Innovation

- About

- Team

- News

- For Industry

- Venture Capital and Investments

- World Medical Innovation Forum (opens link in new tab)

- Featured Licensing Opportunities

- For Innovators

- Commercialization Guide for Innovators

- Contact us

-

- Overview

- Information for Researchers

- Compliance Office

- Research Cores

- Clinical Trials

- Advisory Services

- Featured Research

- Two Centuries of Breakthroughs

- Advances in Motion (opens link in new tab)

- Brigham on a Mission (opens link in new tab)

- Gene and Cell Therapy Institute

- Research News

- Alzheimer's Disease

- Artificial Intelligence

-

- Overview

-

- Overview

- Residency & fellowship programs

- Brigham and Women's Hospital

- Massachusetts General Hospital

- Mass Eye and Ear

- Newton-Wellesley Hospital

- Salem Hospital

- Integrated Mass General Brigham Programs

- Centers of Expertise

- Global & Community Health

- Health Policy & Management

- Healthcare Quality & Patient Safey

- Medical Education

- For trainees

- Prospective trainees

- Incoming trainees

- Current trainees

- Continuing Professional Development

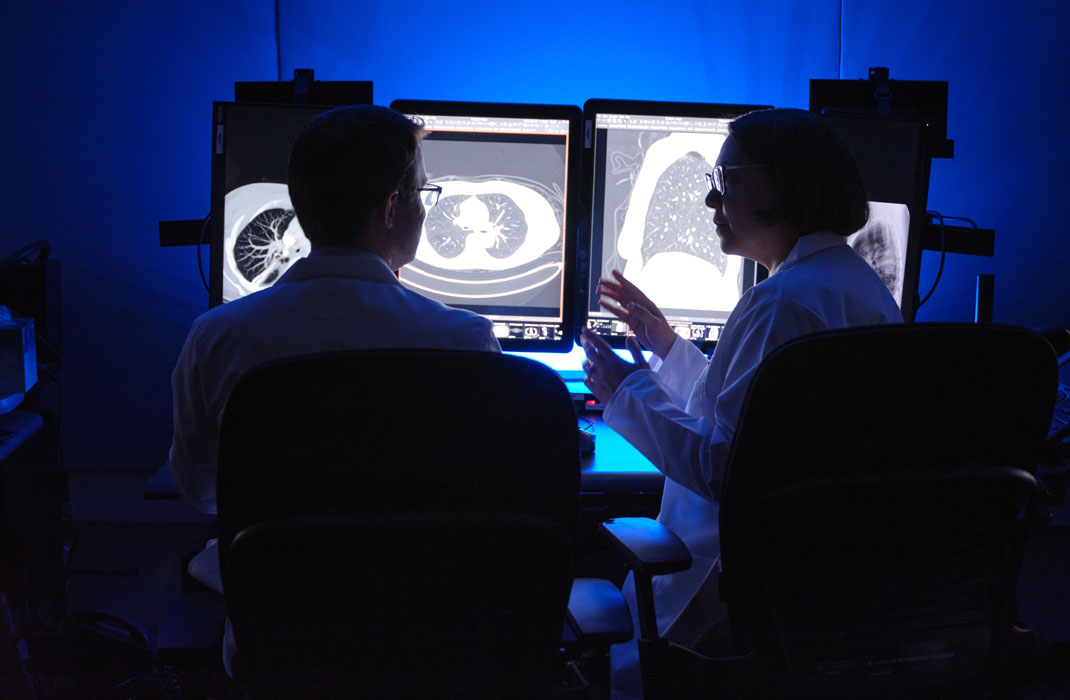

Artificial Intelligence and Digital Health in Radiology: A Guide for Innovators

Artificial intelligence (AI) and digital health are transforming radiology, driving the diagnostic imaging market towards an estimated $34.6 billion by 2028, according to a new paper published by Gaye Bok in the Journal of the American College of Radiology. Bok, a practicing venture investor and head of Mass General Brigham’s AI and Digital Innovation Venture Fund (AIDIF), outlines essential insights for radiology innovators looking to commercialize their groundbreaking technologies in this space.

As AI technology continues to advance, radiologists, researchers, and technologists are innovating to improve patient outcomes. However, securing funding remains critical to transforming these innovations into viable businesses. Bok’s paper, titled "Investing in Artificial Intelligence and Digital Health—What Radiology Innovators Need to Know," offers strategies for navigating the current funding landscape. She highlights the importance of understanding funding sources, building scalable business models, and effectively managing investor expectations, offering a clear roadmap for securing venture capital and private equity to support successful commercialization.

"Navigating the investment landscape for AI and digital health in radiology requires more than just innovative technology,” said Bok. “It demands the ability to present a compelling business model that addresses market needs and regulatory challenges and a deep understanding of investor priorities.”

Bok emphasizes that investors are long-term partners, and strong relationships with them are crucial to sustaining growth. Entrepreneurs should carefully evaluate potential investors to ensure alignment with their business vision and needs. Additionally, understanding an investor's current position in their own fundraising cycle is key—whether their investment is part of a new fund or an older one could influence their exit strategy and overall support. By building strong connections with investors and developing a robust business model that addresses unique challenges in radiology, innovators can better position their technologies for long-term success.

While the current venture financing landscape for radiology innovators presents challenges, such as increased investor caution and the demand for capital efficiency, those who offer differentiated solutions and demonstrate strong business fundamentals are still likely to attract attention and support. By aligning their innovations with investor priorities and market needs, these innovators will continue to shape the future of radiology.

To read the full paper, visit Journal of the American College of Radiology.

Related research about artificial intelligence

-

published on

-

published on

-

published on

-

published on

-

published on

-

published on

-

published on

-

published on

-

published on